This post is brought to you in association with RALF from DP Software and Services. I’ve used RALF for the many years, and it’s my favourite RAJAR analysis tool. So I am delighted that I continue to be able to bring you this RAJAR analysis in association with RALF. For more details on the product, contact Deryck Pritchard via this link or phone 07545 425677.

Methodological Note

Welcome to another RAJAR day. As with the previous release, the first since RAJAR was suspended during lockdown, RAJAR continues to work to slightly adjusted methodology. What this means is that you shouldn’t really make direct comparisons with previous data beyond last quarter. Therefore, you’ll only see Quarter on Quarter comparisons in this blog.

It’s also worth remembering that RAJAR uses multiple quarters to provide listening data. While the larger national stations only need a single quarter’s worth of data to get numbers, smaller stations either need six months of data, or even a year’s worth of data.

What that means practically is that for national stations, the measurement is broadly for late September to mid-December, while for big regional stations (and many groups), the data is from last summer through until December. Finally, the very smallest stations are still using some element of pre-pandemic data for their numbers.

What all this means is that you can’t instantly base this quarter’s results on solely, say, October to December listening.

With that out of the way, let’s get into it.

Overall Trends

Radio continues to reach 89% of the population with 49.5m listeners each week. Indeed, you have to go to several decimal places to actually find a difference in listening between this quarter and last quarter overall!

Listening hours are slightly down, -0.8% on last quarter, but still with over 1 billion hours.

The BBC has seen a slight overall decrease of 0.3% in reach to 34.5m a week (62% of the adult population). Hours are down 2.6% to 501m hours. But that’s still a small lead over commercial radio in terms of hours.

Commercial Radio’s reach fell 0.1% in the last quarter to 36.8m reach (66% of the population), but hours grew 1.1% to 482m hours. So commercial radio maintains its lead over the BBC in reach.

Perhaps the key demo to keep an eye on is 15-24s which could be a bellwether for wider listening behaviours.

Amongst this group, 75% of the population listen each week rather than 89%. But while the overall radio listener consumes 20.3 hours of radio a week, this falls to 12.1 hours a week amongst 15—24s (although that figure is actually up from 11.5 hours a week last quarter).

And while both the BBC and commercial radio have seen small declines in reach amongst 15-24s, both have increased their hours. Either way, the BBC now reaches 43% of 15-24s while commercial radio reaches 61% of them.

One interesting thing to note is that 64% of radio listening is now through some kind of digital platform, with 36% being through “traditional” AM/FM listening. And that rises to 66% if you just consider 15-24s. And it even goes up to over two thirds (67%) if you look at 15-44s. So it’s not the very youngest adult listeners that are driving digital radio listening.

Finally, it’s also worth having a look at overall listening trends through the weekday. While Omicron came along right at the end of the year and working from home was the official government advice just before Christmas, many people had started going back to work for the first time in many months.

Last time around I noted that although there remained a breakfast peak, listening through the day remained high suggesting a lot of listening was still at home. The pattern is not vastly different this quarter. When using average quarter hours across Monday-Friday, the All Radio peak time is still 0800-0815. But it’s still remarkably high at 0900 and remains so right through until mid-morning.

What that also means is that for a strong daytime station like Radio 2, Ken Bruce’s show (0930-1200) with an audience of 8.7m is bigger than Zoe Ball (0630-0930) with 7.5m. While Bruce had just overtaken Ball pre-pandemic, the lead is substantial now. Ken Bruce has the largest audience on UK radio.

But mid-morning being bigger than breakfast isn’t solely a Radio 2 phenomenon. If you look at LBC, James O’Brien (1000-1300) has 1.308m listeners, which is just bigger than Nick Ferrari (0700-1000) with 1.295m.

National Stations

Going through the main national stations, Radio 1 has seen a slight fall in reach on the quarter, down 1.0% to 8.2m, although hours are slightly up to 53.9% (+0.7% on the quarter). The standout at Radio 1 is Greg James, who is going well and bucking the overall station trend by gaining 4.4% in reach and 8.0% in hours compared to last quarter. That gives him 4.3m overall listeners (Note: I use adult 15+ listeners here. Radio 1 prefer to use the 10+ audience for Radio 1, but I try to be consistent).

1Xtra hasn’t had a good quarter seeing reach and hours fall. Reach is now at 744,000 (-15.5%) and hours are at 2.7m (-18.9%).

Radio 2 has small gains in reach (+1.8%) to 14.9m while hours are essentially flat (+0.1%) at 164m – that’s about one in six hours of all radio listening being to Radio 2. Zoe Ball’s reach is up to 7.5m (+3.9%) with hours up to 24.6m (+1.5%).

Radio 3 comes off its Proms quarter falling (-7.9%) to 2.0m reach and 14.5m hours (-12.1%).

Radio 4 suffers smaller falls with reach at 10.5m (-2.8%) and hours at 117m (-5.2%). The Monday-Friday Today programme is down 1.0% to 6.5m listeners. Radio 4 Extra also saw falls with reach at 1.9m (-7.2%) and hours at 14.1m (-7.3%).

Five Live had some key changes in Q4, with Nicky Campbell leaving the breakfast show to host a new morning show on the channel (re-jigging the morning schedule a bit), while Rick Edwards joined Rachel Burden on breakfast. That all happened in November, so while it’s captured in this quarter, it may not be fully incorporated into the data just yet. But it’s also worth mentioning that it was a big sports period with Premier League football back, and things like the F1 season run-in taking place. Anyway, the station lost a marginal 0.4% reach to 5.9m overall. Hours were down to 34.1m (-2.7%).

6 Music also had a perhaps smaller change when Shaun Keaveny left in September. 6 Music is a strong daytime performer – so a change in daytime might have some impact on listening. Reach was down to 2.6m (-3.1%) while hours were down to 25.6m (-5.1%). But the fall isn’t all down to Craig Charles taking over! His show is only down 1.8% on Keaveny’s final quarter.

BBC World Service didn’t have a great quarter with reach down to 1.2m (-11.0%) and hours down to 6.2m (-14.8%).

Looking over at the commercial landscape, let’s start with LBC who had some decent results. Reach for the main LBC station is up 1.7% to 2.6m listeners, although hours fell to 26.8m (-1.6%). If you factor in the LBC Brand, which includes LBC News, their rolling news service, then the reach jumps to 3.2m (+4.9%).

Over at Global stablemate, Classic FM, reach was basically flat at 5.1m (-0.3%) while hours fell a smidge to 43.0m (-1.9%). Bauer’s classical service Scala is at 400,000 – basically flat on the quarter (+0.3%) while hours jumped to 2.6m (+7.6%).

Looking at some of Wireless Group’s big brands, Times Radio fell back from their debut figures last quarter with reach down to 502,000 (-21.2%) and hours down to 3.1m (-10.5%). However, there was better news for most of the rest of News UK’s radio brands.

talkSPORT, also with plenty of football to cover, saw its reach grow to 2.8m (+3.9%), although hours fell a little to 16.8m (-5.5%). Sister station talkSPORT2 is much smaller and its reach fell to 389,000 (-22%) with hours dipping even more to 817,000 (-44%). talkSPORT2’s audience can be very dependent on sports rights – for example, cricket.

talkRADIO saw reach grow to 542,000 (+20%) and hours to 4.6m (+34%).

And the Virgin stations all collectively did well with Virgin Radio up 1.9% to 1.6m reach and up 7.1% to 10.0m hours. With their digital services, Groove, Anthems and Chilled all seeing gains, the overall Virgin Radio Network was up to 2.1m (+8.2%) while hours were up to 12.0m (+10.0%). All of this means that Chris Evans’ audience is back over a million with 1.0m (+1.9%) although his hours are at 3.9m (-7.0%).

While we’re looking at Virgin, let’s also check out Graham Norton’s show on the main station from 0930-1230 on Saturdays and Sundays. He moved there from his Radio 2 show of course back at the start of last year. His reach is now 523,000 (-7.1%) with 1.1m hours (+0.2%).

The Jack Brand continues to grow now making a total of six stations. Combined they reach 312,000 (-1.6%) with 1.4m hours (-6.0%).

Checking out to see how newcomer Boom Radio is doing shows that their reach is to 242,000 (+3.9%) and hours are up 2.5m (+36%). I suspect that David Lloyd and Phil Riley will be pleased with those numbers.

Commercial Brands

Let’s go through some of the big brands from the major groups.

Global, it’s worth remembering, also has a big outdoor advertising business, and I’ve certainly noticed an awful lot of advertising for Global’s radio brands on some of their outdoor sites. That’s very handy if there’s unsold inventory.

Overall, Total Global Radio Sales is at 25.8m (+0.6%) with 242m hours (+2.3%).

Across the entire Capital Brand, there was little change in reach with 7.6m (-0.4%) and 36.6m hours (+2.3%). Just looking at the main Capital Network reach was down slightly at 6.3m (-2.7%) but notably Capital XTRA fell to 1.4m (-11.6%) in reach.

The Heart Brand had a good quarter with reach up to 10.3m (+2.5%) and hours at 64.3m (+3.0%). The main Heart Network was at 8.5m (+0.5%) while Heart 80s climbed to 1.4m (+3.3%) and the smaller Heart 90s also grew to 595,000 (+17.4%) which is worth noting and comparing with Absolute Radio 90s below.

The Smooth Brand was up 1.0% to 6.0m in reach and up 3.0% to 40.2m in hours. But perhaps more notable was Radio X’s growth this quarter. Reach was up 8.6% to 2.1m while hours were up 13.2% to 18.2m making it a good quarter for the station.

Bauer has made news in the last few days with an announcement that it is removing its services from nearly all streaming platforms beyond its own. In essence this means that you won’t be able to listen to its services via TuneIn, but that also means many listeners’ internet radios are suddenly going to stop working as well.

These days, the money is in first party data – Bauer wants you to log in and know who you are.

Overall, Bauer has a reach of 20.6m across its various stations and networks (based on its total sales offering), which is essentially flat on the quarter (-0.3%). Hours are down -0.9% to 173.7m.

Across Bauer’s Hits Radio Brand (Sales), they have a reach of 10.0m (-2.5%) and hours of 90m (+0.8%).

Perhaps most interesting is Greatest Hits Radio Network which has had a strong RAJAR. It’s reach is up to 4.1m (+7.9%) with hours at 33.1m (+10.7%). In London, where they took over Absolute Radio’s FM frequency a while back, reach is up 49% to 818,000 while hours are up 53% to 5.0m.

While Simon Mayo is perhaps that standout presenter on Greatest Hits, not long gone from drive on Radio 2, he’s not as big as Simon Ross at breakfast, Mark Goodier in mid-mornings or Debbie Mac in the afternoons. But all their key shows have grown this quarter making for a very successful venture.

The Absolute Radio Network did well with a reach of 5.3m (+2.8%), and hours of 36.1m (+1.6%). But the main station was down to 2.2m (-13.7%) with hours down to 14.6m (-7.8%). This quarter also saw Absolute 80s fall to 1.6m (-5.0%) while Absolute Radio 90s rose 8.0% to 1.0m. Are we seeing the shift from 80s to 90s that is largely threatened by time?

The Kiss Network is at 4.5m (-4.4%) and hours at 21.9m (-3.3%). The main Kiss station was flat on reach at 2.8m, but Kisstory remains the number 1 digital only commercial station up 2.0% to 2.3m with 9.8m hours (+1.0%).

Finally the Magic Network was down a little to 4.1m reach (-1.2%) and 23.6m hours (-7.2).

Other Things to Note

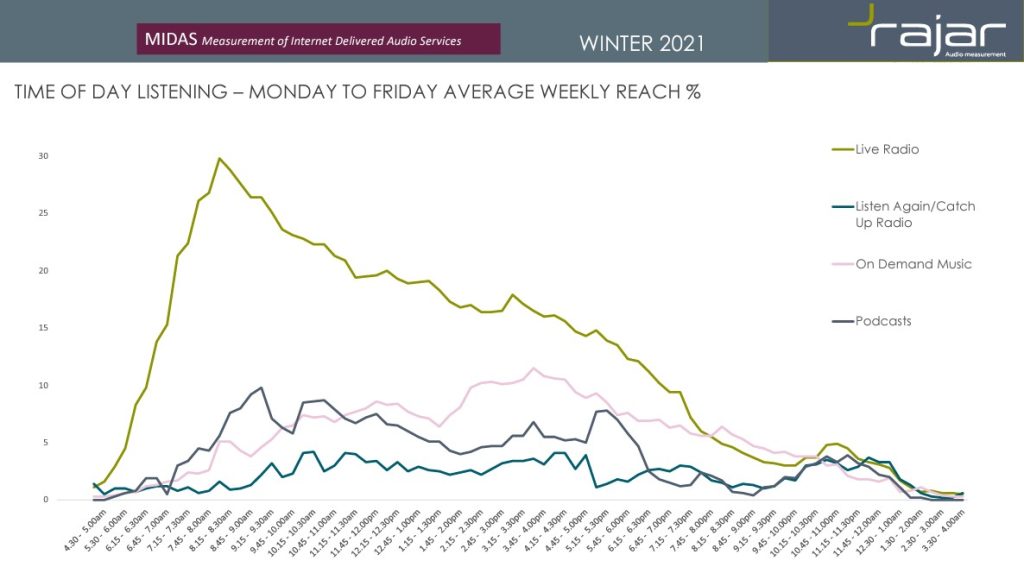

Last week RAJAR released its latest MIDAS report. This is a separate survey to RAJAR but they did show continued growth in podcasts, now reaching a weekly reach of 20%. And remember, that listening time is going to have to come from somewhere.

More concerningly for some stations, on demand music listening (i.e. streaming to services like Spotify) is now up to 35%. That is listening that is surely eating into radio.

The other useful fact to glean from this release is that 94% of podcast listening is alone, whereas for radio that’s only 54%. But the whole report is worth reading.

Since I’ve been very frugal with the charts this quarter, I’ll include one time of day listening chart from MIDAS that shows when people listen to various forms of audio on weekdays. Radio is much as it has ever been, but the pattern of podcast listening is very different , and listening during late breakfast is very interesting.

Further Reading

I’ll be talking to Matt Deegan about RAJAR on this week’s Media Podcast out on Friday. Sign up if you haven’t already!

The official RAJAR site

Radio Today for a digest of all the main news

Matt Deegan always has great analysis, and you should probably sign up for his Substack email

Media.Info for lots of numbers and charts

Mediatel’s Newsline will have lots of figures and analysis

BBC Mediacentre for BBC Radio stats and findings

Bauer Media’s corporate site

Global Radio’s corporate site

Radiocentre’s website

All my previous RAJAR analyses are here.

Source: RAJAR/Ipsos MORI/RSMB, period ending December 19th 2021, Adults 15+.

Disclaimer: These are my views alone and do not represent those of anyone else, including my employer. Any errors (I hope there aren’t any!) are mine alone. Drop me a note if you want clarifications on anything. Access to the RAJAR data is via RALF from DP Software as mentioned at the top of this post.

Edited to remove a stat about smart speakers that doesn’t really apply until next quarter.